Although we never like to think about it, more than 5 out of 12 Canadians will suffer a stroke, heart attack or being diagnosed with cancer or heart disease. While many of these Canadians will be able to recover to an almost-normal lifestyle, the recovery process can be long and very costly. After factoring in lost time from work for the patient, as well as the time required for one or more of the family members to assist in the recovery period – the costs could easily reach well over $10,000. Multiply that over and over again if the patient never fully recovers. While most Canadians carry some sort of life (death) insurance for their families to live on, where is the financial aid needed if you are fortunate enough to live on?

How can we protect ourselves from living?

This is where Canadians can (and should) take advantage of a refundable critical illness policy. CI (critical illness) insurance is a living benefit that pays out when you face a life-threatening disease or event – and instead of succumbing to it, you survive. Based on the policy, you can cover yourself for the “Big 4” (heart attack, cancer, stroke, coronary heart bypass surgery), or get a more advanced policy that will cover up to 26+ illnesses including dementia, MS, or severe injuries. Even better yet – with the proper plan – if you don’t use it, you get your money back!

Did you say get your money back?

Yes, some insurance carriers will offer you a full refund of your premiums when you add a “Return of Premiums” (RoP) rider to your plan. Let me explain how it works:

- Choose your policy amount (Usually starting at $10,000 and can go up to $1M in value).

- Add a RoP rider, which will return 100% of your premiums (including the cost of the rider) should you not make a claim before the policy matures (usually after 65 years of age).

- If at any time you are diagnosed with an eligible disease or injury, the policy will pay out at the face value after a 30-day waiting period.

What’s the catch? Somebody needs to make money!

Well in Las Vegas terms, the odds favour the house. Where 5 in 12 are likely to file a claim – the other 7 will be entitled to a full refund of their funds. The risk is taken by the insurance company, as they look to invest your premiums and hope to make more money on the investments than they did on the policy.

How expensive is the Insurance?

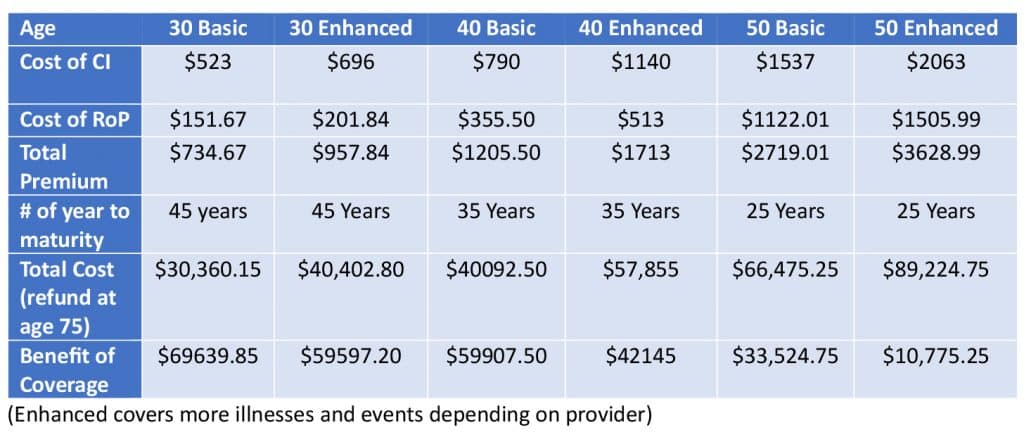

It depends on a few factors; your age, your health, and amount of coverage you’d like. In the table below, you will see some estimated costs annually for a 30, 40, or 50-year-old male to purchase a $100,000 policy that expires at age 75.

Let’s look at an example!

Meet Buzz and Boomer – identical twin brothers who just turned 40. As they have aged, they have lost lots of loved ones to cancer and heart attacks. After Buzz met with his financial advisor at OBS, he was introduced to critical illness insurance. He then shared the information about this coverage to his brother, should something happen. Both brothers went into OBS to see their respected advisors, and purchased a $100K policy until their 75th birthday – for $108 a month.

Boomer is fortunate enough to live a full healthy life. Upon his 75th birthday, he received 100% of the premiums back, as there was no claim – Boomer received $40,092. Although you lose potential investment gains, the risk of being diagnosed with an illness is insured, and the funds sit in a “bank account” until policy is matured. You receive the premiums back tax-free.

Fifteen years into the policy, Buzz is diagnosed with cancer – and survived the 30-day waiting period. Withing six weeks of his diagnosis, Buzz was paid the full-face value and had $100,000 in his bank account. After looking back at his policy premiums over the fifteen years, Buzz calculated his out-of-pocket premiums. He was shocked to see he’d only spent $17,182! This CI policy provided his family with a tax-free income of over $80,000, which allowed his wife to stay home and help with his recovery – without any financial burden on the family.

Ready to get started? Contact Carsen Dokken at OBS Financial for a FREE consultation at 204-444-5678 or investments@obstax.com. Carsen can assist with account set-up, and provide best investment advice tailored to you – so you can get the most benefit out of your FHSA, or any investments you make.

Follow OBS Financial on Instagram (@obsfinancial) or on Facebook by searching OBS Financial – Oakbank for helpful tips, friendly reminders, and up-to-date information on new tax information.

This information does not constitute legal, tax or other professional advice. Information is believed to be accurate, but accuracy is not guaranteed.