While the Canadian housing market might be scary, owning a first home is not out of reach – and it’s never too early to start saving for your first home. If you are 18 or over, you are eligible to sign up for a new registered plan – appropriately called the First Home Savings Account (FHSA). Our experts at OBS financial have done the research for you – so we can help you get the most out of your FHSA. Read on for valuable tips, and all the information you need to get started.

What is an FHSA?

The FHSA is a registered plan that gives first-time homebuyers the opportunity to invest up to $40,000 for the purchase of a first home on a tax-free basis. Like a Registered Retirement Savings Plan (RRSP), contributions are tax-deductible, and withdrawals to purchase a first home—including from investment income—are non- taxable, like a Tax-Free Savings Account (TFSA).

Key Features of an FHSA

- The FHSA is for Canadian residents 18 to 71 who do not currently own a home or have not owned a home in which they lived at any time in the last four calendar years.

- Annual contribution limit of $8,000.

- Lifetime contribution of $40,000.

- Unused contribution room can be carried forward from past years up to a maximum of $8,000.

- Income earned is not taxable.

- Unused FHSA proceeds can be transferred to a RRSP or Registered Retirement Income Fund (RRIF) on a tax-free basis.

The FHSA is for Canadian residents 18 to 71 who do not currently own a home or have not owned a home in which they lived at any time in the last four calendar years.

How much can I contribute to a FHSA?

- You can contribute $8,000 each calendar year. The lifetime limit on contributions is $40,000.

- You can claim an income tax deduction for contributions made each tax year. Unlike RRSPs, contributions made within the first 60 days of a given calendar year are not attributable to the previous tax year.

- For tax purposes, FHSA contributions can be carried forward and deducted in a later tax year.

How much could this save for my down payment?

The short answer is, over $100,000 in as little as five years. By using your FHSA, TFSA, RRSP and your tax returns, along with some conservative investments returns, we can show you how to easily save over $100,000 over a five year period and the best news is:

- Your required savings would be 1/3 less than your Mortgage payment would be

- The increased downpayment would reduce your mortgage payment by 40% over the next 25 Years

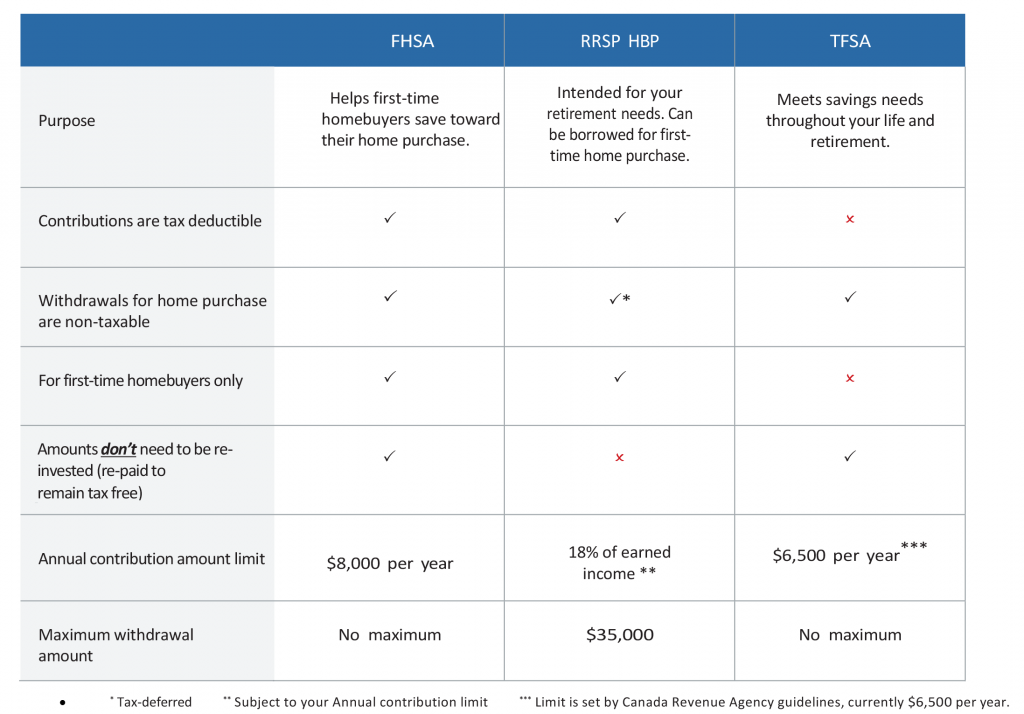

How does the FHSA compare to the RRSP Home Buyer’s Plan (HBP) and TFSA?

What is my contribution room?

- Your carry forward amount must not exceed $8,000 and you cannot contribute more than $16,000 in the same calendar year. For example, if you contribute $1,000 in year one and $1,000 in year two, you can only contribute $16,000 in year three.

- You can carry forward any unused portions of your annual contribution limit. For example, if you contribute $5,000 in year one, you can contribute the unused amount of $3,000 in year two, in addition to your annual contribution limit of $8,000 for a total of $11,000 in year two.

- Unlike a TFSA, you do not accumulate contribution room if your FHSA has not yet been opened.

- If you withdraw money from your FHSA unrelated to a home purchase, this contribution room is not reinstated the following year.

You can contribute $8,000 each calendar year. The lifetime limit on contributions is $40,000.

What if I contribute more than my limit?

If your contribution exceeds your annual limit, you are subject to a 1% tax per month. This means if you contribute $9,000 in September of year one, you will pay 1% of $1,000 per month until January of year two.

What is a qualifying withdrawal?

- You must have a written agreement to buy or build a home in Canada by October 1st of the year after you make the withdrawal.

- You must intend to live in the home as your principal residence within a year of buying or building it.

- All FHSA funds may be withdrawn on a tax-free basis in a single withdrawal or a series of withdrawals. There is an exception that allows you to make qualifying withdrawals within 30 days of moving into your home.

Can I use both the HBP and FHSA to purchase a home?

You can use both the HBP and the FHSA for a first home purchase with a maximum of $35,000 under the HBP. There is no maximum from the FHSA. Your $40,000 contribution to the FHSA can grow to a much larger amount by the time you are ready to purchase your home. You will not need to pay back the FHSA withdrawal however, the HBP withdrawal must be repaid.

How long can I keep the FHSA?

What if I decide not to use my savings to purchase a home?

Your FHSA can remain open until December 31 of the year you turn 71.

If you have not used the money 15 years after opening the account, the balance can be transferred to an RRSP or RRIF on a tax-free basis. If you do not transfer it by December 31 following the 15th anniversary after opening your first FHSA, the account balance is declared as income and is taxable.

Ready to get started?

Contact Carsen Dokken at OBS Financial for a FREE consultation at 204-444-5678 or investments@obstax.com. Carsen can assist with account set-up, and provide best investment advice tailored to you – so you can get the most benefit out of your FHSA, or any investments you make.

Follow us on social!

Follow OBS Financial on Instagram (@obsfinancial) or on Facebook for helpful tips, friendly reminders, and up-to-date information on new tax information.

This information does not constitute legal, tax or other professional advice. Information is believed to be accurate, but accuracy is not guaranteed.