Looking to save some money? It’s as easy as looking at your bank statement, read through to see how the differences between term and bank/creditor insurance can help your mortgage and offer you budget-friendly advice.

Purchasing and financing your home is an important milestone in any person’s journey towards financial stability. This is a crucial step in building up equity in your home, increasing your net worth and ultimately your family wealth, so when we see increases in inflation and skyrocketing interest rates selecting the right mortgage and insurance protection options can save thousands of dollars a year. In today’s market and economy, consumers need to ensure that not only are they getting the right mortgage, based on their financial circumstances, lifecycles and tax situation, but also focusing on protecting their hard earn asset’s by selecting the right insurance products that will protect them, for current and all future homes, regardless of what financial or heath challenges are around the corner.

Selecting the right mortgage and insurance protection options can save thousands of dollars a year.

When applying for a mortgage the banks are more than eager to offer creditor protection insurance, at rates based off health and age and mortgage amount. These policies are designed to protect the banks to ensure that they are repaid, and not so much to protect you and your financial future. For example, the life portion of the protection only applies to the current balance, so while every year that you get older, your rates increase, while the coverage amounts decrease. And don’t forget, should you have to remortgage, refinance or decide to purchase a new home, you need to re-qualify all over again, so true protection of your home, will always be in jeopardy, should injury, illness, or other health issues arise with you and or your family.

Here are some key differences between creditor insurance and term life insurance:

So as you can see, if you have your life insurance through the bank, while it maybe good for today, that may not be saying the same for tomorrow.

But what does traditional Life insurance Cost?

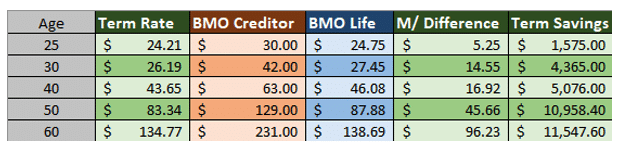

Contrary to popular belief – life insurance is very inexpensive, especially when you compare it to the fees charged for creditor insurance. In the chart below, we have illustrated actual rates from life insurance providers for a $300,000, 25-year term life insurance policy. Although the best term rate, varies by provider (first column) – we have also showed you the rates that you would pay BMO for creditor insurance (as explained on their website) and done a direct comparison with what an insurance broker could sell you a BMO Term Life Policy for. As ou can see, the savings are in the thousands when calculated over the life of the mortgage.

So as you can see, you are probably overpaying for your life insurance with the bank. If you want to know for sure, contact the professionals at OBS Financial Services for a FREE – no obligation review of your current Mortgage and insurance Policies and rates. If we can save you some money, we will assist you with securing your new Insurance, thus allowing your to cancel the overpriced insurance you currently have.

This article is for discussion purposes only and should not be considered financial advice. Prior to cancelling ay insurance policies, you need to be able to confirm replacement coverage. Please consult with a licensed agent for an individual investment / insurance plan before making any decisions.