All financial advice should come real wealth management strategies.

At one time or other, we have all met or worked with financial advisors; whether they are independent, work for big firms, at your bank – there are literally thousands of them. So what does a Financial Advisor do? And what is REAL wealth management? Well, the answer can be complex – however real wealth management advisors understand that the accumulation, growth, preservation, and transition of wealth can only be successful if you factor in taxes, fees (including probate) associated with the investments, as well as inflation. While Financial Advisors focus on the accumulation and growth of your wealth (how much you put in, and how much it grows), they typically do not have the expertise to properly plan for the typical things that can erode your wealth – such as Inflation, fees, and most of all income tax – which could claim as much as 58.4% of your savings if an estate plan is not properly planned or executed.

What is so important about an estate plan?

Throughout your life, you work hard to put food on the table… and if you are fortunate – to put away a little here and there. Simply, you have created wealth. We at OBS Financial are often asked, “how much do you need to have wealth?”, and the answer isn’t black and white. Wealth does not really have a minimum or maximum number, as each person has their own definition of personal wealth. The way we see it, all savings are considered your personal wealth. A properly created estate plan will ensure that when the Grimm Reaper arrives to carry us off to post-retirement, your hard-earned legacy will be left to your loved ones – and not support The Tax Man through a death tax.

What is a death tax?!

Well in Canada, we don’t really have a “death tax”, however we do have “deemed disposition”. What that means is that all of your RRSP’s, RRIF’s LIRA’s, LIFS, Investments, collectables, business shares, and assets must be assessed and taxed on your tax return at fair market value . Although there may be some small tax exceptions like the primary residency capital gains exclusion, everything of value that you own will be subject to tax on your final tax return. Under progressive taxation rules, OAS claw-backs and the loss of other tax credits, you could find your estate paying upwards of 58.4% tax on these assets, to Revenue Canada!1

But wait – there’s more! Other fees associated with a poor estate plan can be…

In addition to income tax, there are other fees that need to be factored in based on the size of your estate. These fees vary by Province, and include items such as; probate administration fees, probate tax, accounting and tax preparation fees – not to mention legal and professional fees. We also must consider the time it takes to finalize the estate – and the loss of earning potential while the funds that sit in an estate account. And let’s not overlook the undue hardship passed on to the benefactors as well. They must wait until the income tax returns (as many as four different returns may be filed) are filed, and a clearance certificate is obtained from the CRA – allowing the Executor to release funds to the beneficiaries. The rule of thumb is 12 to 18 months, depending on what time of year the person passes away – and that is if no-one contests the will.

With professional guidance and proper suggestions, you can make the most difficult time for your loved ones a whole lot easier

Is there a better way to avoid the process, and have investments and funds paid out directly to the beneficiaries?

The short answer is yes. With professional guidance and proper suggestions, you can make the most difficult time for your loved ones a whole lot easier. Most financial advisors and banks specialize in security and bank notes, which are all subject to estate probate rules. When these types of investments are instead provided by insurance companies (Seg Funds), they offer guarantees and advantages, such as the ability to bypass the estate – where payouts go directly to the beneficiaries within weeks and not months. At the same time, they’re saving the estate administration and probate fees that would normally need to be paid out.

So how much could wealth management save you?

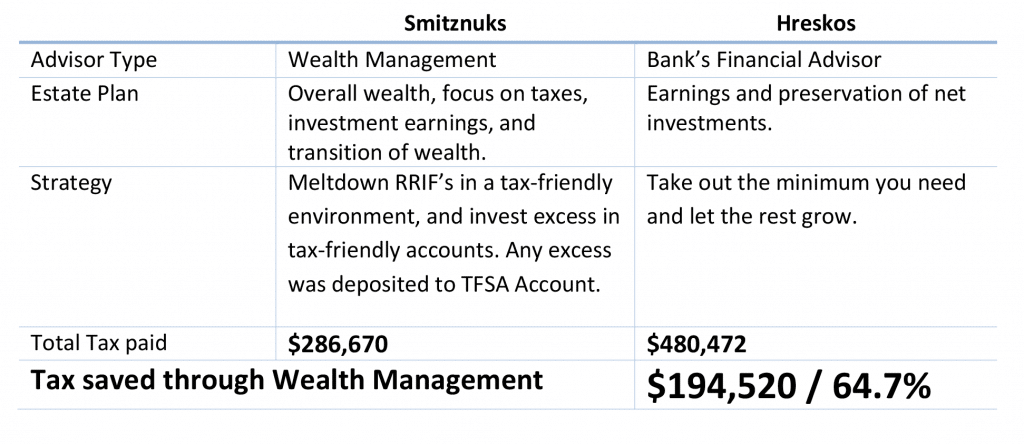

Meet the Smitznuks and the Hreskos. The couples were inseparable, and they knew each other their entire lives. Both couples worked hard throughout their lives, and managed to retire with RRSP’s worth $800,000 at the age of 65. At retirement, they required an after-tax income of $6,700 per month ($2,750 each), and they receive CPP and OAS of $1,660 each. Their investments yielded a rate of 6%.

Mike and Mary Smitznuk had an advisor who focused on overall wealth, and built a plan that would not only would meet their financial needs, but would minimize their overall tax bill and leave more money for their loved ones.

Joseph and Annie Hresko believed in the local Credit Union and acted on their advice – where the focus was take out what you need, and leave the rest to grow.

At the age of 70, both Mike and Joe were involved in a horrible potato-mashing incident, which caused an explosion.. and they both passed away. Meanwhile, the ladies lived on another 10 years… until they got washed away during a tsunami while limbo dancing in Indonesia on their annual getaway.

What do I need to do to get started?

The first step of a good estate plan is to find the right team of people that practice REAL Wealth Management. Ideally you find a group of individuals that have specialized knowledge in the areas of investments, income tax, insurance, tax law and estate planning. Now, as there is no one out there that can possibly know it all – they need to be aligned with a team of professionals who have the knowledge when asked. If you have an existing financial advisor:

- Ask them if they have a tax plan to ensure that your RRSP’s and RRIF’s are withdrawn in the most tax-efficient manner. This means not just taking the minimum that you need, and kicking the tax can down the road to 50% – but focus on the after-tax value of your account right up to post-retirement. If you are retired and they have not built you a plan, or If they resist the idea of building one when you are ready, it’s time to find a new advisory team.

- If you find yourself searching for a new team, ask them who does their tax and estate planning, find out who they use for legal services (in most cases that should be 2 or 3 different lawyers who specialize in different areas).

- Don’t forget to ask them how they get compensated. In a lot of cases the investments and insurance products pay the advisors, so you don’t have to. However, there may be costs associated with tax planning, legal fees, administration fees, etc.

- Next – set up a meeting to review your net worth and income, and ask them to develop a preliminary retirement/estate plan. Although this plan will just be preliminary, it will give you a good idea of what you can expect if you switch over to them.

- After this, meet with the Wealth Manager (a Wealth Manager is like a quarterback – so you may not meet the entire team, but he is there to represent them). It is a great idea to invite your executor and/or family members to this meeting so that they:

- Know who your advisor is.

- Understand why things are being done the way they are.

- Ask questions.

- Review the plan with them. A good advisor will take time to do this properly – consult with his team, and make sure everything is customized to you.

- And finally – if you are comfortable with the plan, and can see that it will save you money in the end, ask him to prepare the contracts and paperwork to transfer your investments to his team.

As you can see, there is a lot more to estate planning than just investing your money. If you want to find out more about how our team at OBS can assist you, contact us to set up your free, no-obligation inro consultation. We look forward to meeting with you, and helping you keep your hard earned money.

1Based on Manitoba tax rates. Other provinces will vary.

The above article is for information purposes only, and should not be construed as financial advice. For financial advice or guidance, please see a licensed financial advisor to assist you in developing your wealth management plan